volume and range by weekday: spot the best days to trade with real data

this week, we're tackling a critical concept that can make or break your profitability as a trader: understanding how volume and range by weekday data creates high vs. low probability trading days.

this is a topic we’re passionate about and is one that we don’t see many write on, so let’s get to it:

why volume and range actually matter in trading

as traders, we're always looking for an edge. most are looking for this edge in price action and don’t care about volume — but what if I told you that approach is completely wrong and that there are two other key factors at play that are going to determine the profitability of your setup?

those two factors are range and volume.

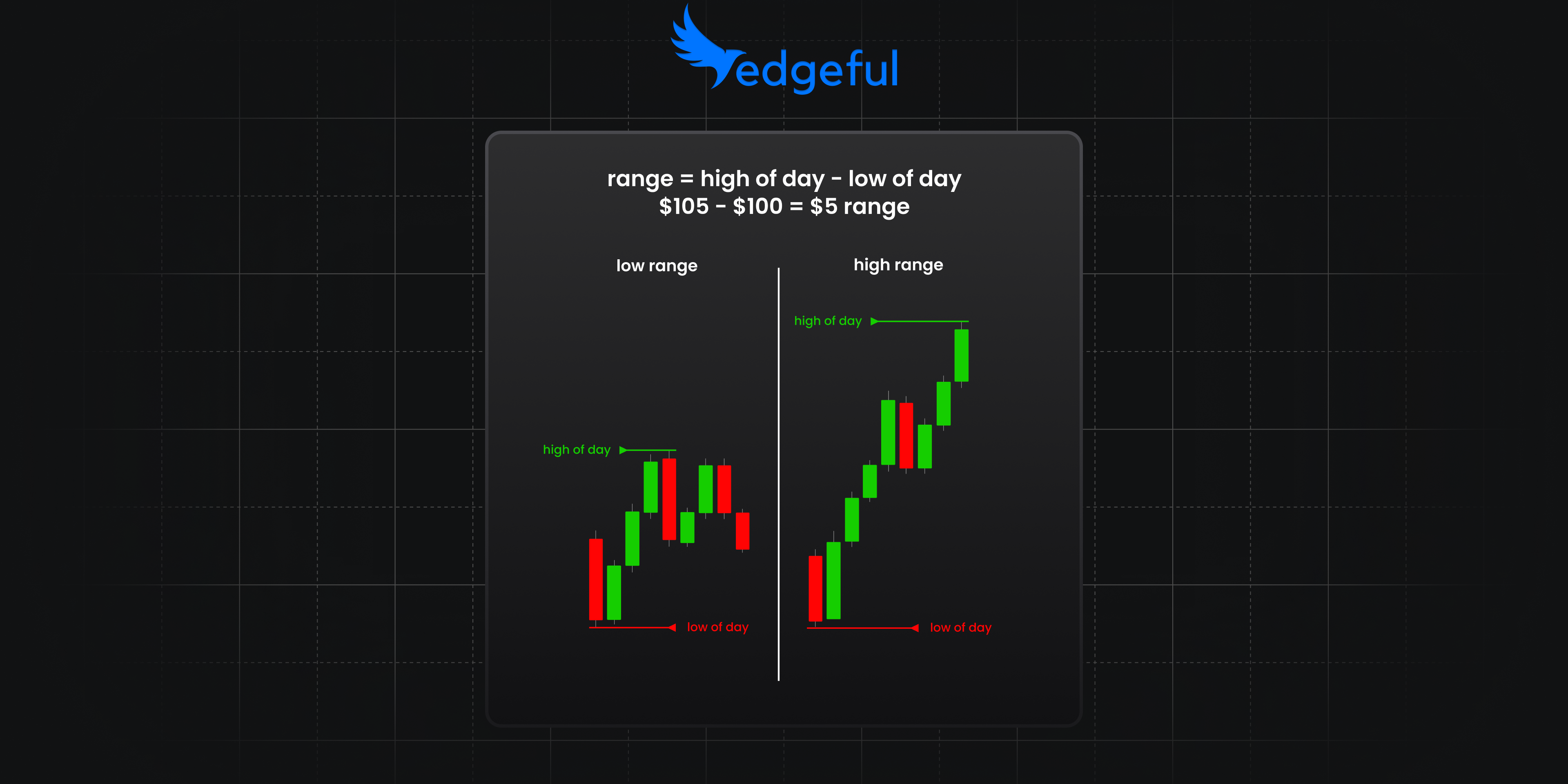

what is range in trading?

we’re all familiar with range — this is simply the distance between the high and low of any given period. wider ranges potentially mean more profits (or losses) per trade, while narrow ranges can limit opportunities and set up range-bound markets.

why volume fuels breakouts

what’s this got to do with volume? glad you asked…

volume is the fuel behind any movement you see in price. without enough volume (buying volume or selling volume), the market lacks the momentum to sustain big directional moves. this often leads to choppy, range-bound conditions that can be tough to navigate.

why weekdays play a huge role in volume and range

we say this all the time to our members — one of the most powerful benefits you get by using edgeful is the ability to slice data based on the day of the week. when it comes to volume and range by weekday, the day of the week is everything.

so, how do volume and range typically play out across the trading week? let's take a look at the stats for es using our volume and range by weekday report:

you can access the report pictured above by clicking here.

notice anything?

- mondays consistently see the lowest average volume, as well as the lowest average range across the trading week.

- wednesdays, thursdays, and fridays see the highest range as well as the highest average volume.

and this isn’t just a coincidence. it makes perfect sense… more volume = more momentum for price to carry on into the direction of the day’s established trend. these are the days you want to be trading, holding your runners, setting profit targets farther away, and focused on taking advantage of the ranges the market is giving you.

how to use the volume and range by weekday report

es volume & range patterns

quick thought exercise:

how many of you have gone back and looked at your profitability on mondays? my guess is it’s low — and when you look at the volume and range by weekday data above, this is not a surprise.

on days with lower volume, there’s typically lower range. lower range means less of a shot you’re going to hit price targets, and that price is likely to stay within normal range values. that means you're going to be incredibly frustrated trying to force a breakout trade that has no real shot of working in the first place.

using atr to validate range expectations

and speaking of normal range values… let’s look at es’ stats for atr:

in the image above, we’ve flipped over to our average true range (atr) report, and selected the “by weekday” subreport (number 7 on the left sidebar). here you can easily see that es has an 88% chance to stick within the 14-day atr, correlating perfectly with our expectation that price will not have much momentum either way due to lack of volume.

comparing high vs. low probability days

now compare those stats to days like Wednesday or Friday and you get a completely different picture:

wednesday's likelihood to exceed the daily atr is nearly 3x what it is on monday — exactly why it’s important to know when you should be trading aggressively and when you shouldn’t be.

Friday:

mirroring the same percentage values as wednesday, which match up directly with the stats on the volume and range by weekday report.

real trading examples based on weekday stats

two examples from es, highlighting the exact stats we outlined above:

Monday example: low volume & range

here's january 27th, 2025 which happened to be a monday. not surprising to see small ranges and frustrating price action.

Friday example: big breakouts & trend continuation

here's that friday:

completely different trade outcomes, and completely different emotions as well (frustrated on monday vs. thinking how good of a weekend you're about to have as the market closed on friday).

all because you listened to the data.

key takeaways from volume and range by weekday data

so what are the clear takeaways from the images above?

- volume and range are directly correlated. the more volume, the bigger the ranges.

- you want to be focused on taking advantage of these bigger range days as capturing only a few of them have the chance to make your entire year.

- in the same sense, you want to avoid trading aggressively on the low volume/range days, as it’s very unlikely you’re going to get a sustained move in either direction.

- for es, it’s best to avoid mondays and tuesdays, and focus on trying to capture outsized moves on wednesday, thursday, or friday.

we highly recommend running the two reports above on the main tickers you trade to see how the stats change — it’s likely you’re missing out on a major edge (knowing when to push it vs. when to sit back) and can improve drastically in a short period of time.

putting it all together: your volume & range trading plan

boom! we’ve covered a lot already in today’s deep dive. so let’s end it with an actionable plan to help you start factoring volume and range by weekday into your trading plan:

- study the volume, range, and atr data for your favorite markets across different weekdays. look for days that are low volume & range vs. days that are high volume & range.

- check this data with your existing setups and strategies. are there certain days where your edge is stronger or weaker?

- build a day-by-day playbook with guidelines for when to be aggressive, when to be selective, and when to sit out.

once you’ve done that, the action items are even more clear:

- be selective on low-volume days (like monday on es). consider reducing how much you trade or size down to account for the lower probability of big moves.

- focus on high-volume days for your best setups. this is when you're more likely to see the range and volatility needed for your strategies to play out.

- you can double check the volume and range by weekday report stats by looking at atr, and then set realistic profit/loss orders accordingly.

one of your biggest edges as a trader is learning how to use volume to know when to push it vs. when to sit out — and the volume and range by weekday report helps you do just that.

bonus analysis: volume and range by weekday on ym

we wanted to leave you with one more ticker that we’ve taken a deeper look at — this time it's ym.

YM weekday volume & range breakdown

- Monday represents the lowest volume and second lowest range (avoid trading Mondays!)

- Wednesday represents the highest range and second highest volume (potentially get aggressive wednesdays)

- Thursday's volume & range actually normalize a little and don't stand out as much as wednesdays or fridays

- Friday represents the second highest range, and highest volume (potentially get aggressive Fridays)

ATR confirmation for YM strategy

let’s check what the ATR report says for Wednesday:

37% price breaks out of the 14-day atr range on ym.

compare this with Friday and you’ll see that wednesday has a tangible difference in probability to exceed the 14-day ATR:

final thoughts: trade the days that give you the edge

so if I was regularly trading ym and wanted to hone in on my strategy, I would primarily focus on trading wednesdays (and if you’re scared of fomc, use our fomc report). my secondary option would still be to trade fridays, but with less of an expectation for an outside of atr move.

the analysis above took me no more than 5min to run — and is exactly what you should be doing with your favorite tickers.

- check which days are highest volume + range

- double check with the atr values + by weekday subreport

- build a trading plan that matches the data

that’s the best part about our tools. they are easy to use and provide you with actionable data that you can legitimately apply tomorrow if you wanted to.

so… go run the data: check the days you will and won't make money.