edgeful's ultimate guide to trading psychology: consistent trading starts in your head

why your mental game matters more than your trading strategy

welcome to the ultimate guide on trading psychology - the missing piece that separates consistently profitable traders from everyone else.

we've spent months diving into specific trading strategies, reports, and setups. but something keeps coming up in conversations with thousands of traders in our community:

the mental game of trading is where most people struggle.

you can have access to the best data, the most accurate reports, and the highest probability setups, but if your trading psychology isn't where it needs to be, you'll never see the consistent profits you're working toward.

in this comprehensive guide, we're going to tackle the three biggest psychological challenges traders face:

- information overload (leading to overtrading or hesitation)

- fear of losing profits or fear of missing out (FOMO)

- inconsistency in decision-making processes

and we'll share an actionable 11-step checklist that top performers use to transform their approach to every single trade.

mental issue #1: information overload - the silent account killer

one of the most common issues we hear from traders is the feeling of needing to be in on every single price move. with so much information available to you with the click of a button, it's easy to get caught up in the noise and think that every price movement is an opportunity.

but here's the truth: not every uptick or downtick is tradeable. trying to always be in the market is one of the quickest ways to overtrade and eventually blow your account.

on the flip side, information overload can lead to second-guessing and hesitation. you end up with analysis paralysis – so much data at your disposal that you miss great trades because you can't make a decision.

the one-strategy solution elite traders use

to cut through the noise and stay focused, we challenge you to:

- pick a single strategy that resonates with you

maybe it's gap fills, opening range breakouts, or another concept we've covered. Focus all your energy on mastering that one setup on your favorite ticker. - only trade that strategy for at least 1-month straight

no matter how attractive trading another setup might look, stay disciplined and only trade the strategy you've committed to.

your success as a trader doesn't depend on knowing dozens of setups – it depends on your ability to trade one setup better than anyone else in the market. discipline to commit to this is EVERYTHING.

mental issue #2: conquering fear and FOMO once and for all

another critical aspect of trading psychology is having the discipline to take the trades you plan, and then letting those trades work out without interference.

traders who lack this discipline typically have:

- losers that outpace their winners

- a downtrending account balance

- a trading approach that's just a few bad trades away from blowing up

the only way you'll have the confidence to SIT and let a trade play out is if you know what to expect on both winning and losing trades. this is where becoming a master of a single setup comes in.

using data to build unshakeable confidence

use data (through reports and your own trading journal) to identify:

- logical areas to set stop losses

- logical areas to take profits

- consistent risk outcomes for your setup

- what happens at the start of winning trades (are you usually in the green immediately or do you have to wait?)

- what happens at the start of losing trades (are you usually red immediately or do you have to wait?)

the only way you're going to have the confidence to not second-guess your strategy and start letting your winners run is by relying on data, not emotions.

this comes down to your willingness to study past trades and build a playbook of winners and losers. we can give you access to reports and data that help you identify entries/exits and establish your bias, but your willingness to dig deep into your setup is what will make you successful.

mental issue #3: inconsistency - the profit killer

inconsistency in trading comes in many forms:

- sometimes following your plan, sometimes not

- sizing up on certain trades based on feelings

- moving stop losses when you shouldn't

- taking profits too early when you're afraid

each of these inconsistencies kills your profitability over time, leading to frustration and diminished results.

the solution to inconsistency

the solution is simple but powerful: systematize everything. don't leave any decision to be made in the heat of the moment.

by following a consistent pre-trade, during-trade, and post-trade process, you remove the opportunity for your emotions to interfere with your decision-making.

the professional trader's 11-step checklist for unstoppable consistency

to help you overcome these psychological challenges, we've developed a comprehensive checklist used by professional traders before, during, and after every trade.

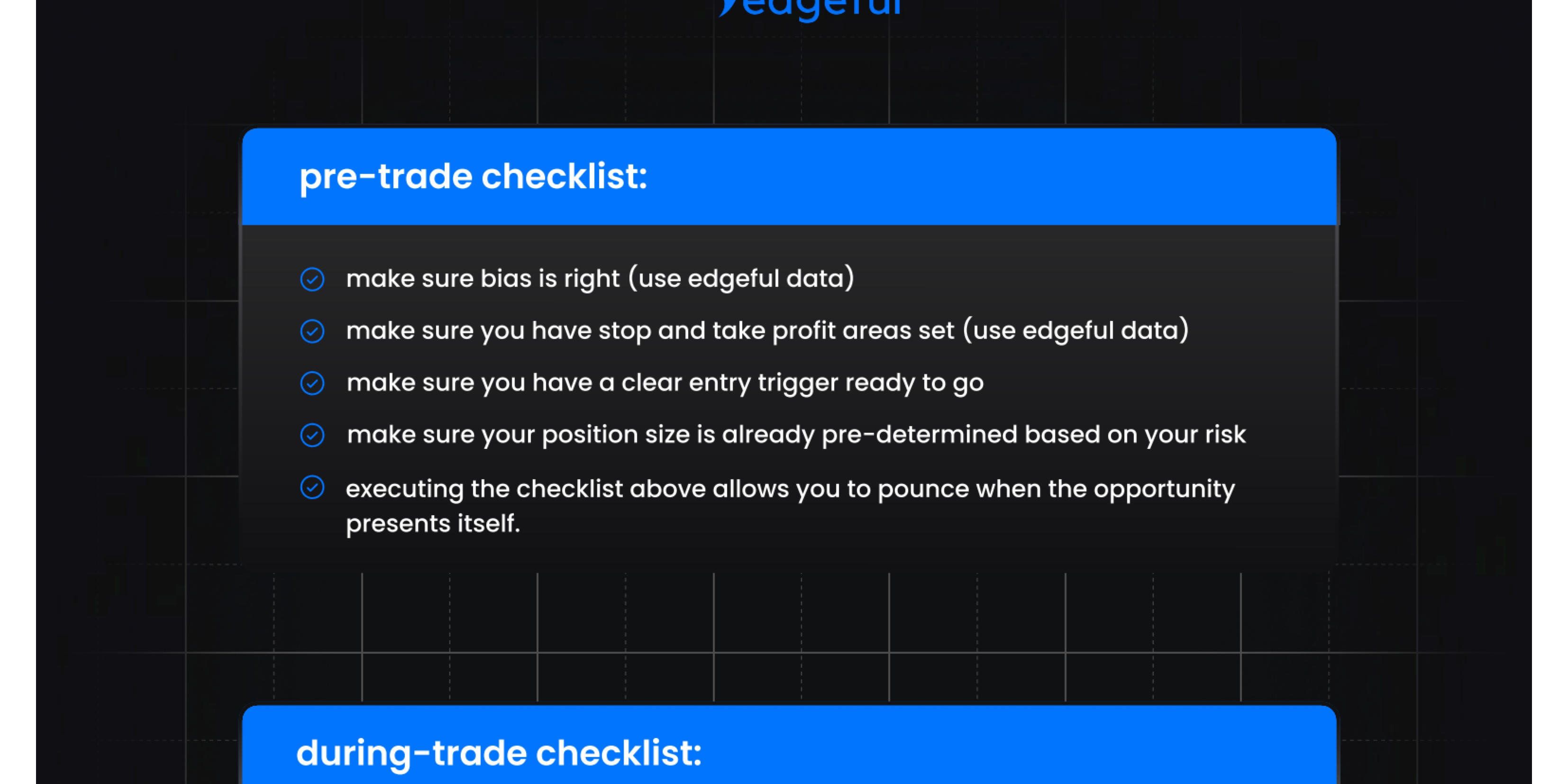

pre-trade checklist (4 steps)

- confirm your bias is correct (use data, not gut feelings)

- establish stop loss and take profit levels (based on data, not arbitrary numbers)

- define a clear entry trigger

- pre-determine your position size based on your risk tolerance

executing this checklist allows you to pounce when the opportunity presents itself without hesitation or second-guessing.

during-trade checklist (3 steps)

- ensure stop and take profit orders are set

- watch price action but do not interfere with your orders

- be ready to move your break-even order once price moves in your favor

if you find yourself still micromanaging your trades, step away from the computer once your orders are set. this eliminates the emotional response to normal price fluctuations.

post-trade checklist (4 steps)

- grade your execution from 1-5 (1 being poor, 5 being excellent)

- determine what you could have done better

- if the trade was a big winner — add to your playbook

- if the trade was a big loser — add to your playbook

these final 4 steps are perhaps the most important of the entire checklist. if you don't review your performance, how do you expect to improve?

the psychological edge: why top traders focus on process, not results

at the end of the day, successful trading is about so much more than just finding the right setups. it's about mastering your mindset, staying disciplined, and focusing on the process instead of the results.

building your trading psychology muscle: daily practices

implementing these mindset shifts doesn't happen overnight. it requires consistent practice and reinforcement. here are some practical ways to strengthen your trading psychology:

- print out the trading checklist and keep it next to your trading station

- log your emotional state before and after trades in your journal

- celebrate process victories, not just profit victories

- review your trading journal weekly to identify psychological patterns

- take breaks when you notice emotions running high

remember that trading psychology isn't about eliminating emotions – that's impossible. it's about recognizing emotions and preventing them from interfering with your trading plan.

advanced psychological tactics used by professional traders

once you've mastered the basics, consider implementing these advanced psychological tactics:

1. the 24-hour rule

after a big win or loss, wait 24 hours before making any changes to your trading plan. this prevents recency bias from affecting your decision-making.

2. the paper trading reset

if you've had several losing trades in a row, switch to a simulator for a few trades to reset your psychology and regain confidence in your strategy.

3. the accountability partner

find another trader to review your trades with regularly. having to explain your decisions to someone else can prevent emotional trading.

4. the physical cue

develop a physical ritual (like taking three deep breaths) before entering every trade to center yourself and ensure you're trading your plan, not your emotions.

the bottom line: data beats emotion every time

if there's one thing we want you to take away from this ultimate guide, it's this:

rely on data from reports and your own trading history – those are the two indicators you need to trade on the most.

most traders lack confidence because they rely on gut feel and emotions to make decisions in a fast-paced, constantly changing environment. by shifting to a data-driven approach and implementing the 11-step checklist we've outlined, you'll develop the psychological foundation needed for consistent trading success.

your path to psychological mastery starts now

want to start putting these lessons into practice right away? download our printable pre-trade checklist designed to help you overcome the psychological challenges we've discussed. print it out or have it up on your screen for every trade you take.

you can do that by clicking here!

and remember – just like any skill, mastering trading psychology takes time and practice. be patient with yourself, stay committed to the process, and trust the data.