inside bar pattern day trading strategy: profit from consolidation breakouts

what are inside bars and why do they matter for day traders?

an inside bar is a powerful price action pattern that often gets overlooked by day traders focused on more complex setups. but understanding this simple pattern can give you a significant edge in anticipating intraday price moves and potential breakouts.

so what exactly is an inside bar?

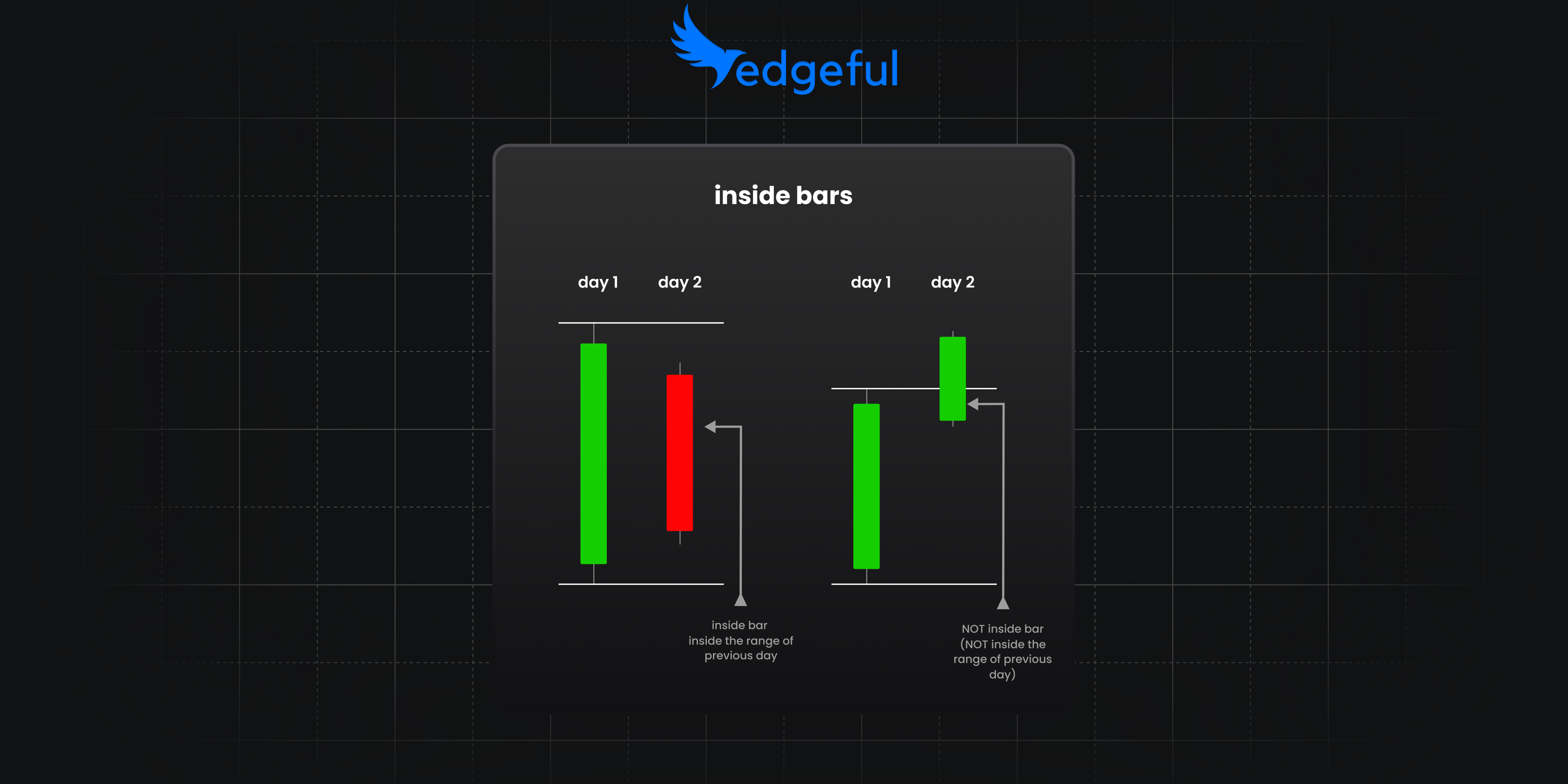

an inside bar occurs when the entire price range (high to low) of a trading session is contained within the range of the previous session. in other words, today's high is lower than yesterday's high, and today's low is higher than yesterday's low.

inside days represent periods of consolidation in the market, where volatility contracts and price "rests" before making its next move. this consolidation is exactly what makes them valuable — they often precede explosive breakouts in either direction, creating perfect opportunities for day traders.

the statistics behind inside bars

before diving into how to day trade this pattern, let's look at what the data tells us about inside bars:

on SPY over the past 6 months:

- inside days occurred only 22% of the time (16 out of 72 trading days)

- price breaks out of the previous day's range 77.78% of the time

the data is telling us that when price opens within yesterday's range — which is already rare to start with — you're identifying a high probability day trading opportunity.

direction matters: understanding breakout tendencies

when an inside day forms, the key question for day traders becomes: which way will price break? answering this question will tell us which side of the previous day's range to target — either the high or the low.

we can use our "by breakout" subreport of the inside bars report to do just that:

analyzing SPY data over the past 6 months shows:

- 52% of the time, price breaks out to the upside and touches the previous day's high

- 40% of the time, price breaks down and touches the previous day's low

this slight upside bias makes sense in a generally bullish market, but the data also shows that directional breaks are relatively balanced, making both long and short day trading setups viable depending on other factors.

what the data is also telling us that targeting both sides of the range — which is a double break — is not a high probability setup (it only happens 15.28% of the time).

the main takeaway from the data is that you should be using one side of the previous day's range for your profit targets.

the power of previous day's range

while the inside bar itself is important, the previous day's range provides crucial context for your day trading decisions. our data on SPY shows remarkably strong patterns after price breaks the previous day's levels:

- when price breaks above the previous day's high, 74% of the time over the last 6 months the session closes green

- when price breaks below the previous day's low, 80% of the time over the last 6 months the session closes red

this data tells you that again, when price breaks above/below the previous day's high/low, you want to be expecting continuation, not a reversal. so on a bullish trade, you could be taking profits at the previous day's high, and leave runners on to capture any continuation moves (which based on the stats, happen 74% of the time over the last 6 months).

building your inside bar day trading strategy

now that we understand the pattern and the probabilities, let's build a complete day trading strategy for inside bars:

step 1: identify an inside bar setup

the first step is simply to identify when an inside bar has formed. you can do this by:

- comparing today's high and low to yesterday's high and low

- checking edgeful's inside bar report for your chosen ticker

remember, this is the first step to the setup. price must open within the prior day's high/low to be considered an inside bar!

step 2: wait for the first 30 minutes of price action

once you've identified a potential inside day setup (current session opening within the previous day's range), wait for the first 30 minutes of trading to develop a clear range.

this 30-minute period helps day traders:

- establish a more immediate support/resistance zone

- gauge the initial directional bias of the day

- avoid getting caught in opening volatility

step 3: set your entry points

with the 30-minute range established, you now have clear entry triggers for day trading:

- for long trades: entry above the 30-minute high

- for short trades: entry below the 30-minute low

these entry points allow you to participate in the breakout as it's happening, rather than trying to predict direction in advance.

step 4: determine your stop loss placement

proper risk management is crucial for day traders, and the inside bar setup provides logical stop levels:

- for long trades: stop below the 30-minute low or the previous day's low

- for short trades: stop above the 30-minute high or the previous day's high

your specific risk tolerance will determine which level you choose, but using these natural boundaries helps keep your stop placement objective rather than arbitrary.

step 5: establish profit targets

based on our data analysis, the previous day's levels make excellent profit targets for day traders:

- for long trades: target the previous day's high with potential to hold for the close

- for short trades: target the previous day's low with potential to hold for the close

remember the statistics: when the previous day's high/low breaks, there's a strong tendency for price to close beyond that level, making this an excellent candidate for a runner position.

a real-world example: inside bar day trading in action

let's examine a real example on SPY to see how this day trading strategy plays out:

- SPY opens within the prior day's range, triggering a potential inside day setup

- after the first 30 minutes, a clear trading range develops

your short entry

- entry: break below the 30-minute low

- stop: above the 30-minute high

- target: previous day's low

- result: 1.88R profit (where R is your risk unit)

here's a different example:

trade 2: long entry

- entry: break above the 30-minute high

- stop: below the 30-minute low

- target: previous day's high and beyond

- result: nearly 5R profit as price found support at prior day high before closing strong

this example demonstrates how waiting for the breakout direction rather than predicting it allows day traders to capitalize on the market's momentum regardless of which way it moves.

fine-tuning your approach with additional factors

while the basic inside bar strategy works well on its own, you can enhance your day trading edge by considering:

market context

- overall trend direction (inside bars often continue the prevailing trend)

- key support/resistance levels near the previous day's high/low

- volume patterns during the inside bar formation

time-based factors

our data shows that inside bars behave differently depending on the day of the week. using the "by weekday" report, you can adjust your day trading expectations based on whether it's Monday, Friday, etc.

ticker-specific tendencies

inside bars on SPY behave differently than those on QQQ, individual stocks, or futures. always check the specific data for your chosen day trading instrument.

putting it all together: your inside bar day trading plan

to summarize the complete inside bar day trading strategy:

- identify: spot potential inside days when price opens within the previous day's range

- wait: allow the first 30 minutes to establish a trading range

- enter: trade breakouts of the 30-minute range in either direction

- manage risk: set stops at the opposite side of the range

- target: use previous day's high/low as initial targets

- consider runners: potentially hold positions through the close based on the statistical edge

by following this process and letting the data guide your decisions, you can day trade inside bars with confidence and a clear statistical edge.

wrapping up

inside bars represent a simple yet powerful price action pattern that you can add to your day trading toolkit. by understanding the statistical tendencies of these setups and following a structured approach to trading them, you can transform what looks like sideways price action into profitable opportunities.

remember these key points:

- inside bars are relatively rare (occurring only about 12% of the time on SPY)

- when they form, price almost always breaks out of the previous day's range (88% probability)

- previous day's highs and lows serve as excellent targets with a strong tendency for price to close beyond these levels once broken

master this pattern, and you'll have a reliable strategy for capitalizing on consolidation before the next big move in your day trading.